Across Australia, cases of fraud continue to rise as scammers and dishonest individuals adopt more advanced tactics to deceive families, businesses, and even government systems. Recent reports from Scamwatch show that financial losses are increasing each year, often because warning signs are subtle and difficult to recognise early. With more people relying on digital communication and remote interactions, a private investigator has become an essential professional for identifying hidden behaviour and uncovering the truth before the damage becomes serious.

Why Fraud Is Harder to Spot Today

Fraud doesn’t always start with obvious lies or dramatic behaviour.

Many cases begin with small inconsistencies, changed stories, or financial details that don’t align.

Modern fraudsters use:

- Fake identities

- Altered documents

- Social engineering

- Hidden bank accounts

- Digital manipulation

- False injury claims

- Business expense abuse

Because of this, everyday Australians, small business owners, and even large organisations often miss the earliest signs.

A private investigators job is to recognise patterns that others overlook.

1. Inconsistent Personal or Financial Information

One of the strongest early indicators of fraud is inconsistency.

- Giving different addresses

- Changing parts of their story

- Avoiding questions about work

- Mismatched identification documents

- Unknown aliases

- Unexplained income sources

- The online profile doesn’t fit their accent

These inconsistencies are often brushed aside as simple mistakes, but they are exactly the types of signals investigators look for. These discrepancies are easy to miss without professional verification tools. A PI can run cross-checks through databases, public records, and digital footprints to confirm whether someone is who they claim to be.

2. Avoiding Verification or Direct Contact

Fraudsters rarely enjoy being questioned.

Common red flags include:

- Avoiding face-to-face meetings

- Refusing to provide documentation

- Delaying when asked simple questions

- Switching communication channels

- Using multiple phone numbers

- Blocking or disappearing suddenly

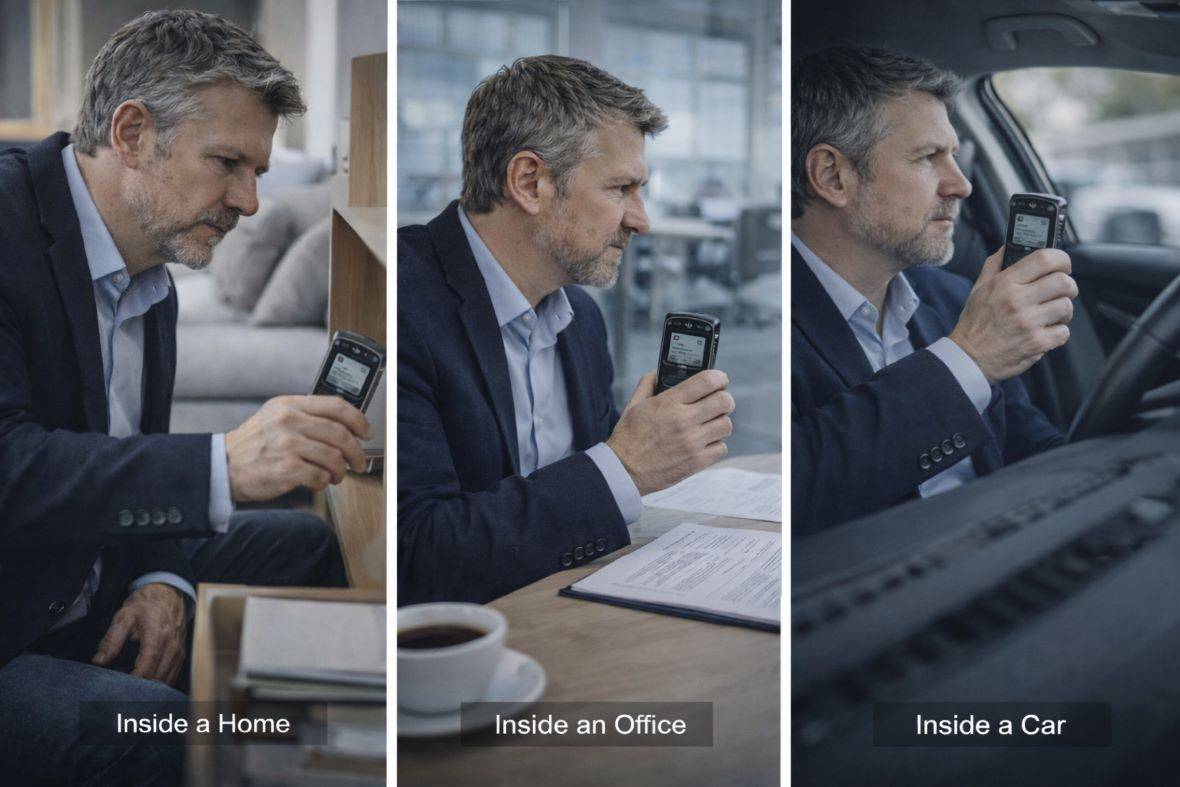

While it may seem like harmless scheduling issues, private investigators recognise this as a clear strategy used by people hiding something. By approaching the situation discreetly, you can test the person’s behaviour, look for inconsistencies, and confirm whether their reluctance is a sign of fraudulent intent or something more benign.

3. Lifestyle That Doesn’t Match Their Income

Another red flag appears when a person’s spending habits or lifestyle do not match their known income. This can include unexplained luxury purchases, sudden access to money, or financial behaviour that doesn’t fit their job or background.

These signs are widespread in:

- Romance scams

- Internal business fraud

- Insurance claims

- Relationship property disputes

- Financial manipulation cases

When money movements and lifestyle choices don’t align, it’s often a sign that someone is hiding income, committing fraud, or funding their life through illegal means.

4. Suspicious Injury or Insurance Behaviour

Australia sees a high number of false injury claims each year, from workplace injuries to car accidents.

Private investigators often catch signs of:

- Exaggerated injuries

- Completely false claims

- People working or exercising while claiming to be injured

- Contradictions between medical documents and real behaviour

- Insurance fraud for suspicious injury

Through surveillance, online checks, and professional reporting, a PI can gather evidence to protect individuals and businesses from major financial losses.

5. Digital Footprints That Don’t Add Up

In 2025, one of the most reliable ways to expose fraud is by following a person’s digital trail. Even when someone deletes posts or avoids social media, there are often traces left behind through old accounts, shared photos, username patterns, or location data. A private investigator can analyse this information to reveal contradictions, secret profiles, and connections to other suspicious accounts. These digital clues are often the missing pieces in fraud cases, helping investigators show what the person is really doing compared to what they claim.

Why Hiring a Private Investigator Matters

Fraud is designed to deceive, confuse, and manipulate, and that’s why victims often don’t notice the warning signs until it’s too late. A private investigator brings professional tools, experience, and legal methods that uncover the truth quickly and safely. Whether you’re dealing with a questionable injury claim, a suspicious new partner, a dishonest employee, or someone who simply won’t give straight answers, the right investigation can protect your finances, your reputation, and your peace of mind.

When You Should Get Help

If you notice unusual behaviour, shifting stories, questionable financial activity, or a feeling that something isn’t right, it’s better to act early. You don’t need proof before reaching out, just concern. A private investigator can assess the situation, gather real evidence, and help you understand what’s really going on.