Introduction

Unfortunately, the insurance industry, which often deals with large sums of money, is a magnet for fraud. Ensuring the authenticity of insurance claims is the crucial job of the Insurance Investigator. And in Australia, where the industry is vast and diverse, these investigators’ role is more pivotal than ever. This comprehensive guide will explain everything you need to know about being an Insurance Investigator in Australia.

Insurance Investigators

Before diving into the intricacies of this profession, it’s essential to have a foundational understanding:

- What is Insurance Investigation? At its core, it involves scrutinizing insurance claims to ensure their authenticity.

- The primary aim? To detect and deter fraudulent activities and false claims that could lead to monetary losses for insurance companies.

The Role of an Insurance Investigator in Australia

In the vast landscape of Australia, the insurance sector thrives as one of the key pillars of its economic framework. At the heart of this system are the unsung heroes – Insurance Investigators. These professionals ensure that the integrity of the insurance process is upheld and only genuine claims see the light of day. Let’s explore the multifaceted role they play in the industry.

Types of Insurance Investigations

In Australia, the realm of insurance spans various sectors, and with each sector comes a unique set of challenges and methodologies for investigations:

- Motor Vehicle Accidents: Investigating car accidents requires a keen eye for detail. Investigators must assess the damage, speak with witnesses, and often use technology like traffic camera footage to ascertain the truth.

- Health Insurance Claims: This often involves verifying medical documents, checking the validity of medical treatments, and even consulting with healthcare professionals to ensure the claim is genuine.

- Property and Home Insurance: For claims related to property damage or theft, investigators might visit the site, assess the damage, verify ownership through documents, and more.

- Life Insurance: This susceptible area demands thorough investigations, especially in unexpected or mysterious deaths.

- Travel Insurance: These claims involve anything from lost baggage to medical emergencies abroad. Each lawsuit demands a unique approach, often involving liaising with foreign entities or authorities.

- Business and Commercial Insurance: With companies, the stakes are often higher. Claims can range from employee injuries to property damages or business interruptions.

Importance of Insurance Investigator in the Insurance Industry

Gatekeepers of Authenticity: Insurance Investigators are the frontline defense against fraudulent claims. Their rigorous assessment ensures that deceitful claimants don’t drain resources that belong to honest policyholders.

Financial Pillars

By ensuring that only genuine claims are paid out, investigators save the insurance industry potentially billions each year. This financial vigilance ensures that insurance companies can continue offering competitive premiums to their customers.

Upholding Trust

The insurance industry thrives on trust. When policyholders feel that the system is just and transparent, they’re more likely to invest in policies. Investigators play a crucial role in upholding this trust by ensuring fairness in claim assessments.

Adherence to Legal Framework

Australia has a stringent legal framework surrounding insurance. Investigators ensure that all claims align with these laws, protecting the insurance company and the policyholder from potential legal repercussions.

Skills Required for an Insurance Investigator

Embarking on a career as an Insurance Investigator, especially in a diverse and complex environment like Australia, isn’t just about being meticulous. It’s a challenging role that demands a blend of soft and hard skills to effectively navigate the intricacies of insurance claims and fraud detection. Below, we delve into the pivotal abilities that can make one stand out in this field.

Analytical Abilities

- Attention to Detail: In insurance claims, minor details can be the difference between legitimate and fraudulent claims. It’s essential to have an eye that can pick up on inconsistencies.

- Data Interpretation: With the digital age upon us, many claims come with digital footprints. Whether it’s understanding patterns in data or reading between the lines in claim statements, a good investigator can connect the dots where many can’t.

Critical Thinking

Not every claim will be cut and dried. Often, investigators will need to think outside the box, questioning the information presented to them and seeking alternative sources of evidence.

Interpersonal Skills

- Empathy: While the goal is to detect fraud, it’s equally crucial to approach genuine claimants with understanding and compassion.

- Effective Communication: This is about more than just talking. It’s about listening, understanding, and then conveying your perspective. Clear communication is essential whether it’s interviewing a claimant or presenting findings to a team.

- Negotiation Skills: Sometimes, claimants dispute findings or need to gather more information. In such cases, being able to negotiate diplomatically can be invaluable.

Knowledge of Laws and Regulations

- Understanding Australian Insurance Laws: This is foundational. Every decision made, and every claim processed, must be in line with the laws of the land.

- Ethical Considerations: Beyond just the law, this role has a moral dimension. Being aware of the ethical implications and acting with integrity is crucial.

- Continuous Learning: The legal landscape isn’t static. New regulations, updates to existing laws, and shifts in industry standards mean that an investigator must be committed to ongoing education.

Steps in an Insurance Investigation Process

The journey from receiving an insurance claim to accepting or denying it involves several systematic steps:

- Initial Report and Analysis: This is the starting point. Here, the investigator reviews the claim’s initial details.

- Gathering Evidence: This is not restricted to just physical evidence. It also involves scrutinizing photographs, videos, and relevant documents.

- Interviewing Involved Parties: Communication plays a massive role here. The investigator talks to everyone involved, ensuring no stone is left unturned.

- Final Report and Decision: Post analysis, a detailed report is drafted. This report becomes the basis for the claim’s acceptance or rejection.

Why You Need to Hire an Insurance Investigator

The complex insurance world is more than just underwriting policies and processing claims. Amidst the sea of genuine claims, deceptive currents of fraud can disrupt the system, leading to financial losses and unfair premiums for honest policyholders. This is where the role of an insurance investigator becomes indispensable. Let’s explore the pressing reasons to hire a professional investigator in the insurance domain.

Protection Against Fraudulent Claims

- Financial Savings: Fraudulent claims can cost insurance companies millions, if not billions, each year. By identifying and rejecting these claims, investigators save significant amounts.

- Maintain Competitive Premium Rates: When insurance companies bear the cost of deceitful claims, they often transfer these costs to policyholders through higher premiums. By weeding out fraud, investigators help keep tips affordable for genuine policyholders.

Ensuring Accurate Payouts

Investigators verify the facts of each claim, ensuring that claimants get payouts that accurately reflect their losses. Some claims have legal ramifications. Investigators ensure that all payouts align with the legal requirements, protecting the insurance company from potential lawsuits.

Upholding the Reputation of the Company

When policyholders see that an insurance company takes steps to ensure fairness, it builds trust. This trust translates to customer loyalty and positive word of mouth. A single high-profile fraudulent claim can tarnish the reputation of an insurance company. By nipping potential frauds in the bud, investigators prevent potential PR disasters.

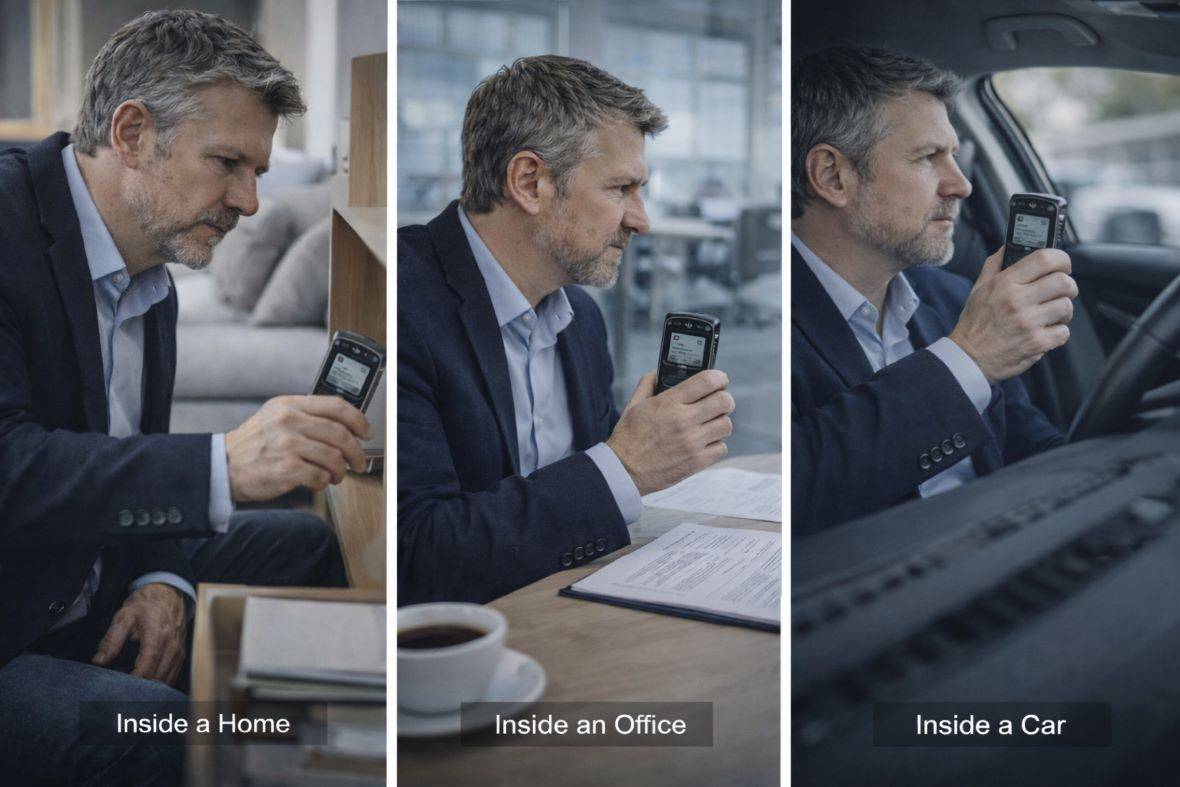

Expertise in Specialized Areas

Insurance investigators have expertise in specific sectors, be it automotive, health, life, or property. Their specialized knowledge ensures thorough and accurate investigations. Modern-day investigators use a combination of traditional detective work and technological tools, from data analysis software to digital forensics, to get to the truth.

Comprehensive Claim Analysis

While claims departments focus on processing, investigators delve deep into the nuances of each claim, ensuring no aspect is overlooked. Detaching from the policy underwriting and claims processing departments, investigators offer a fresh, unbiased view of each case.

Conclusion

The role of an Insurance Investigator in Australia is both challenging and rewarding. As the guardians of the insurance industry’s integrity, they play a pivotal role in ensuring trustworthiness and transparency in the system. If you’re considering a career in this field or are just curious about the process behind your insurance claims, we hope this guide sheds some light on the matter.

At Triumph Australia, we specialize in insurance investigations, bringing years of expertise and a reputation for excellence. Our commitment to upholding the highest investigation standards ensures our clients receive the most thorough and accurate results. And for those who require broader investigative services beyond the realm of insurance, our sister company, Sydney Private Investigation, stands ready. Whether private investigations or advanced surveillance, we’re equipped with state-of-the-art tools and a seasoned team of professionals to handle all your investigative needs. Together, Triumph Australia and Sydney Private Investigation form a comprehensive investigative powerhouse catering to a broad spectrum of requirements in the ever-evolving landscape of Australia.