Introduction

Insurance fraud is a big problem affecting the insurance world everywhere. In this blog, we’re going to explore into “Insurance Fraud Cases: Common Fake Claims” especially in Australia, and look at different parts of this sneaky behavior.

What is Insurance Fraud?

Insurance fraud is a big issue in the insurance world. It’s all about tricking insurance companies to make money. This can be small lies about how much damage was really done, or completely making up events or losses that never happened. This kind of cheating breaks the trust in insurance and makes things hard for both insurance companies and the people they insure. It often leads to higher costs and tougher rules for making claims.

Common Types of Insurance Fraud

Fraud Insurance Claims

This is the most direct form of insurance fraud. Individuals either completely fabricate a loss or exaggerate the extent of a legitimate one. The aim is to receive a larger payout than they’re entitled to, unjustly profiting from the insurance company.

Identity Fraud Insurance Cases

In this form of fraud, a person uses someone else’s identity, without their permission, to file insurance claims. This not only involves deceit but also leads to legal complications and identity theft issues, making it a particularly complex type of fraud.

Insurance Policy Fraud

This occurs when individuals alter existing policy documents or create false policies to claim benefits. It’s not just harmful to insurance companies; it also victimizes people who are misled into purchasing nonexistent insurance coverage, causing both financial and emotional harm.

Impact of Insurance Fraud in Australia

In Australia, insurance fraud is a big deal. Both lone fraudsters and organized crime groups do these scams, causing lots of money loss in the insurance world. This hurts honest people who have insurance through higher costs and tougher checks on claims, making the relationship between insurers and customers less trusting.

Steps for Reporting Insurance Fraud

Identify Suspicious Activity

Be on the lookout for any signs of fraud. This could include exaggerated claims, false information, or altered documents related to insurance.

Gather Evidence

Collect any relevant information or documentation that supports your suspicion of fraud. This could include correspondence, receipts, photographs, or any other evidence that could be useful. In addition to these traditional forms of evidence, don’t overlook the importance of online profiling. This involves examining the digital footprint of the person or entity in question. Look for social media posts, online transactions, and other digital activities that might contradict the details of the claim or expose deceitful behavior.

Contact the Insurance Company

If you suspect fraud related to a specific insurance policy or claim, the first step is often to contact the insurance company directly. Many companies have dedicated fraud departments or hotlines for this purpose.

Report to Authorities

If the suspected fraud is serious or if you’re not comfortable contacting the insurance company, you can report it to local law enforcement or specialized government agencies dealing with financial crimes.

Document Your Report

When you report the fraud, make sure to get a reference number or a copy of the report for your records. This could be important if there are follow-up inquiries or investigations.

Follow-Up

If necessary, follow up with the insurance company or the authorities to check on the status of your report. However, keep in mind that some investigations may take time and the details may be confidential.

Stay Informed

Educate yourself about ongoing efforts and measures to combat insurance fraud. Staying informed can help you better understand the process and the importance of your role in reporting fraudulent activities.

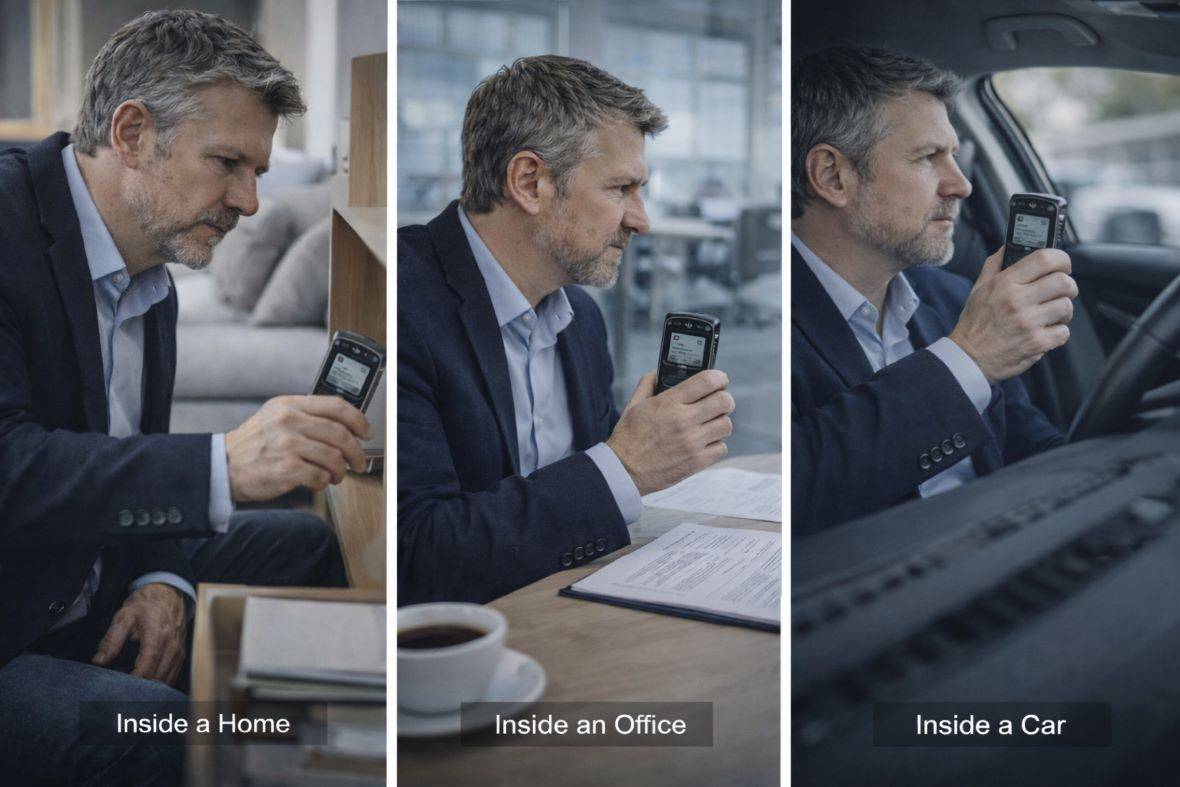

Role of an Insurance Fraud Investigator

Insurance fraud investigators are pros who look closely at iffy claims. They use different ways to check out claims, like background checks, watching people, and digital checks, to see if a claim is true. They play a key role in finding scams and protecting both insurance companies and honest people who have insurance.

Rewards for Reporting Insurance Fraud

Some places and insurance companies give money rewards for telling them about fraud. This encourages people to share info that can help stop insurance fraud and keep the insurance world honest.

Preventing Insurance Fraud

Stopping insurance fraud needs several steps:

- Teaching Policyholders and Staff: Programs that teach both workers and customers about insurance fraud and what it leads to can stop people from trying it.

- Tough Checks on Claims: Having strong processes to check claims helps find and reduce fake claims.

- Using Tech to Find Fraud: Advanced tools and AI can spot patterns and weird things that might mean fraud, helping find scams early.

Signs of Possible Insurance Fraud

Inconsistencies in Claim Details

If there are discrepancies between what is reported in an insurance claim and the actual circumstances or evidence, this could be a sign of fraud. For example, if the damages claimed don’t match the photos provided or the description of the incident is inconsistent with the damage.

Unusual Patterns in Claims

Be wary of patterns that seem out of the ordinary. This could include a person making multiple claims in a short period, or a business that consistently reports the same type of damage or loss.

Anomalies in Documentation

Look out for paperwork that seems altered, incomplete, or contains inconsistent information. Forged signatures, tampered receipts, or documents that appear to be fabricated are red flags.

Suspicious Behavior by Claimants

The behavior of the person making the claim can also be a telltale sign. This might include being overly aggressive about the speed of the claim process, reluctance to provide necessary documentation, or providing vague or evasive answers to questions about the claim.

How Serious is Insurance Fraud

Insurance fraud is more than just a money crime. It breaks down the trust that’s needed for the insurance industry. It makes things cost more for insurance companies, leads to higher prices for people who have insurance, and makes everyone less trusting.

Examples of Insurance Fraud

- Example 1: Someone made up bigger damages from a small car crash. They asked for too much money for repairs and fake injuries, trying to cheat the insurance system.

- Example 2: A person lied about a big burglary at their home. They claimed expensive stuff was stolen that they never had, clearly trying to trick for money.

The Importance of a Private Investigator in Insurance Fraud Cases

Before wrapping up, let’s talk about why hiring a Private Investigator is key in insurance fraud cases. Insurance fraud can be hidden and complex, making it hard for insurance companies or people to find the truth alone. This is where a Private Investigator’s skills really help.

What a Private Investigator Does in Insurance Fraud Cases

- Skills in Investigating: They’re good at watching people, finding evidence, and talking to people to find out about scams.

- Unbiased View: They look at things fairly, making sure the investigation covers everything.

- Knowing the Law: They understand the legal side of insurance fraud, which helps with handling evidence and legal steps.

- Focused Time and Resources: They can spend the time and resources needed for the investigation, which might be hard for insurance companies or individuals.

- Finding Complex Fraud: Some frauds, like messing with insurance policies or identity fraud, can be really tricky and need a Private Investigator’s skills to figure out.

Why Hiring a Private Investigator Helps

Having a Private Investigator can lead to better finding of fraud, saving money for the insurance company or people who have insurance. Their findings can also be important if legal steps are taken against the scammers.

Conclusion

In short, understanding and fighting insurance fraud has many parts. From knowing the usual types of fraud to the work of insurance fraud investigators, every part is important in this ongoing fight. Being aware, watchful, and quick to report odd things are key to stopping and lessening the effects of these scams. Remember, insurance fraud doesn’t just hurt insurance companies; it affects everyone who has insurance and the whole trust in insurance.

Our company, Triumph Australia, is a strong supporter of the fight against insurance fraud. We offer complete solutions to find, look into, and stop insurance fraud. Our team of experts, with the latest tech and lots of knowledge, is focused on keeping insurance practices safe and trustworthy. Whether you’re an insurance company dealing with complex fraud cases or someone looking for advice on how to stop insurance fraud, Triumph Australia is here to help. Our services, made for each unique case, aim to give effective and efficient results. Let us help you protect your interests and keep the honesty in your insurance efforts.