Introduction to Insurance Fraud Investigations

Insurance fraud poses a significant challenge for the insurance industry. It is costing billions of dollars and affecting policyholders and insurers alike. Insurance fraud investigations play a pivotal role in detecting and preventing deceptive schemes. In this blog post, we will delve into insurance fraud investigations. We will explore the various techniques employed—the importance of evidence, the role of technology, and the legal framework in these investigations.

Role and Responsibilities of an Insurance Investigator

Insurance investigators play a critical role in uncovering fraudulent activities. Especially within the insurance industry. By conducting thorough investigations, they help protect:

- Insurers

- Policyholders

- The integrity of the insurance system

Definition of an Insurance Investigator

Insurance investigators are professionals responsible for examining suspicious insurance claims. They identify potential fraud. They have specialized skills and knowledge in investigating insurance-related cases. They use various techniques and tools to uncover fraudulent activities.

Investigative Techniques and Tools

Insurance investigators use a range of techniques and tools to gather evidence. To conduct comprehensive investigations. These may include conducting interviews and performing surveillance. Also analyzing documents and records, utilizing forensic accounting methods. Last, collaborating with other professionals. These professionals are such as forensic experts and law enforcement agencies.

Legal and Ethical Considerations

Insurance investigations must adhere to legal and ethical standards. This is to ensure fairness and protect the rights of all parties involved. Investigators must have a thorough understanding of relevant laws, regulations, and privacy considerations. Adherence to ethical guidelines helps maintain the integrity of investigations. This prevents any potential harm to innocent individuals.

Insurance Fraud Investigations

Insurance fraud refers to the deliberate act of deceiving an insurance company for financial gain. Insurance fraud investigations aim to identify and gather evidence against individuals or groups involved in fraudulent activities. This leads to legal consequences and the prevention of future fraudulent claims.

Definition of Insurance Fraud

Insurance fraud encompasses a wide range of deceptive practices. Including staged accidents, exaggerated claims, fictitious policies, premium fraud, and organized fraud rings. These fraudulent activities put a strain on insurance companies resources. Leading to increased costs for policyholders.

Types of Insurance Fraud

Insurance fraud can manifest in various forms. Some common types include:

- Auto insurance fraud

- Health insurance fraud

- Property insurance fraud

- Workers’ compensation fraud

Each type presents unique challenges and requires specific investigative techniques. This is to uncover fraudulent activities.

Investigation Process

Insurance fraud investigations follow a systematic process to collect and analyze evidence. This involves:

- Reviewing claim documents

- Conducting interviews with involved parties

- Verifying medical records

- Analyzing financial transactions

- Collaborating with specialized experts when necessary

Thorough investigations are crucial to building strong cases against fraudsters.

Techniques for Gathering Evidence in Insurance Investigations

Gathering credible evidence is paramount in insurance fraud investigations. The evidence collected serves as the foundation for uncovering fraudulent activities and supporting legal actions against perpetrators.

Importance of Evidence in Insurance Investigations

Evidence acts as a crucial link between suspicious claims and actual fraud. It provides investigators with tangible proof to substantiate their findings, ensuring a fair and robust investigation process. The weight of evidence can impact the outcome of legal proceedings.

Types of Evidence

Insurance investigators collect various types of evidence during their investigations. These may include physical evidence (e.g., damaged property, medical reports, surveillance footage), testimonial evidence (e.g., witness statements, interviews with involved parties), documentary evidence (e.g., claim forms, financial records), and digital evidence (e.g., email communications, social media posts).

Techniques for Gathering Evidence in Insurance Fraud Investigations

Collection and Preservation Methods

- Discuss the importance of collecting and preserving evidence to maintain its integrity and admissibility in court.

- Explain the use of chain of custody protocols to ensure the evidence is handled and documented throughout the investigation.

- Highlight the role of forensic experts in analyzing and interpreting complex evidence such as digital data, DNA samples, or accident reconstruction.

The Role of Technology in Insurance Investigations

Benefits of Data Analytics and Predictive Modeling

- Explore how data analytics and predictive modeling techniques help identify patterns, anomalies, and red flags in large datasets, enabling investigators to focus their efforts more.

- Discuss how predictive modeling can assist in risk assessment, fraud detection, and claims analysis, leading to proactive fraud prevention and improved decision-making

Leveraging Social Media and Open Source Intelligence

- Examine the use of social media platforms and open source intelligence (OSINT) to gather additional information and insights on claimants or suspects.

- Highlight the importance of respecting privacy laws and ethical boundaries while conducting online investigations and extracting relevant information.

Insurance Investigator’s Interaction with Law Enforcement

- Collaboration in Multi-Jurisdictional Cases

- Discuss the challenges and benefits of collaborating with law enforcement agencies across different jurisdictions in cases involving organized insurance fraud networks.

- Highlight the importance of sharing information, intelligence, and resources to combat cross-border fraudulent activities.

Risk Assessment in Insurance Investigation

Mitigating Fraud Risks through Technology

- Explore how advanced analytics and AI-driven solutions can help insurance investigators identify high-risk claims or individuals based on historical data, behavioral analysis, and fraud indicators.

- Discuss the integration of risk assessment tools within claims management systems to streamline processes and focus on investigations.

Role of Underwriting in Fraud Prevention

- Explain how insurance underwriters play a crucial role in preventing fraud by assessing risks, verifying information, and detecting potential red flags during policy issuance.

- Highlight the collaboration between underwriters and investigators in sharing intelligence and insights to enhance fraud detection and prevention measures.

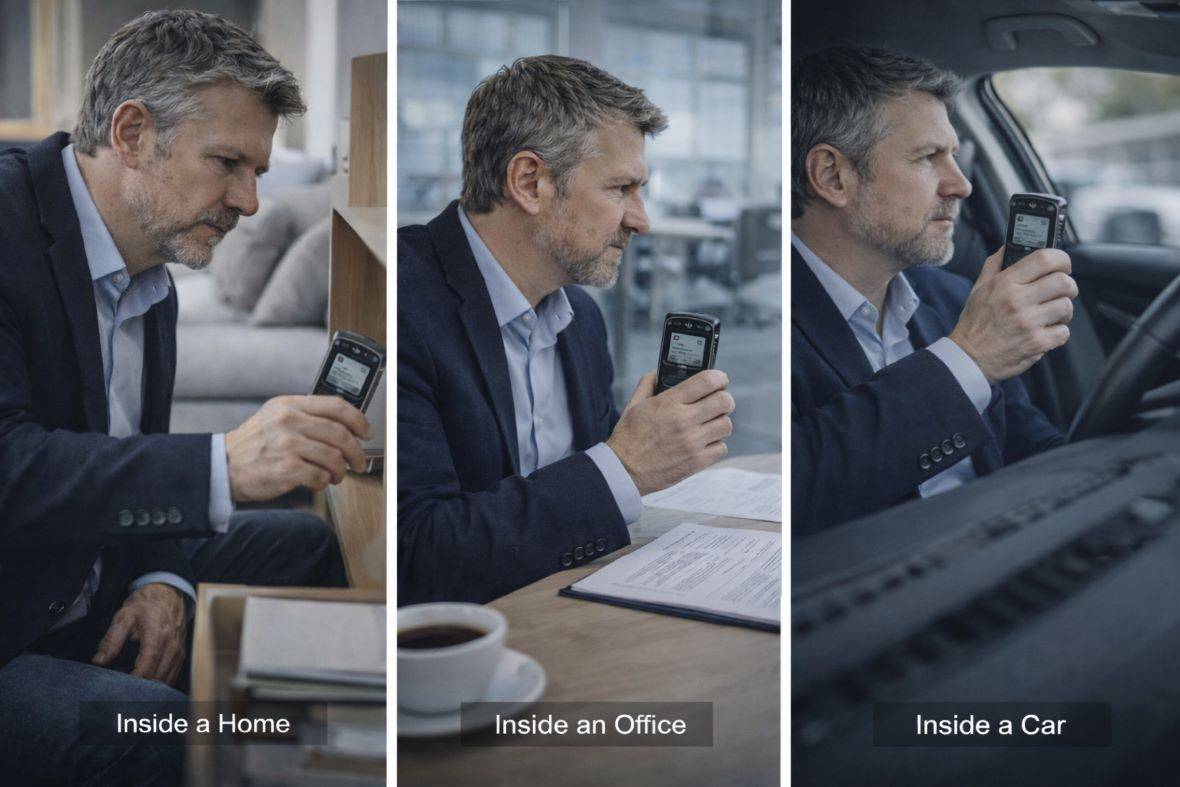

The Importance of Hiring a Private Investigator

When dealing with complex insurance fraud cases, it is crucial to enlist the services of a skilled and experienced private investigator. These professionals have specialized knowledge and investigative techniques. And access to resources that can enhance the effectiveness and efficiency of fraud investigations. Private investigators have a deep understanding of insurance industry practices, legal requirements, and the latest trends in fraudulent activities. By leveraging their expertise, they can uncover hidden evidence, conduct discreet surveillance, and navigate through intricate webs of deception, strengthening the case against fraudsters and maximizing the chances of successful legal outcomes.

Conclusion

In conclusion, insurance fraud investigations are vital in combating fraudulent activities within the insurance industry. By employing various investigative techniques, gathering solid evidence, utilizing advanced technology, and collaborating with law enforcement, insurance investigators play a crucial role in detecting and preventing fraud.

At Triumph Australia, we understand the significance of thorough investigations and offer expert services to support clients in their pursuit of justice and financial protection. With our team of skilled and professional investigators, we are committed to providing comprehensive solutions tailored to the unique needs of each case. Contact Triumph Australia today to safeguard your interests and ensure the integrity of your insurance claims.