The rising cost of false claims isn’t just a headache for large corporations; it’s a burden that trickles down to your own wallet through higher premiums and reduced coverage options. When scammers target the system, they’re essentially stealing from every honest policyholder. You might feel like there’s little to be done against such widespread dishonesty, but that’s where professional private investigations play a crucial role in reducing insurance fraud.

Insurance Fraud Investigations serve as a critical defence, ensuring funds are reserved for those with legitimate needs rather than drained by opportunists. This article explores how modern investigators peel back the layers of deception to find the truth and protect your financial interests.

How Private Investigators Uncover Insurance Fraud

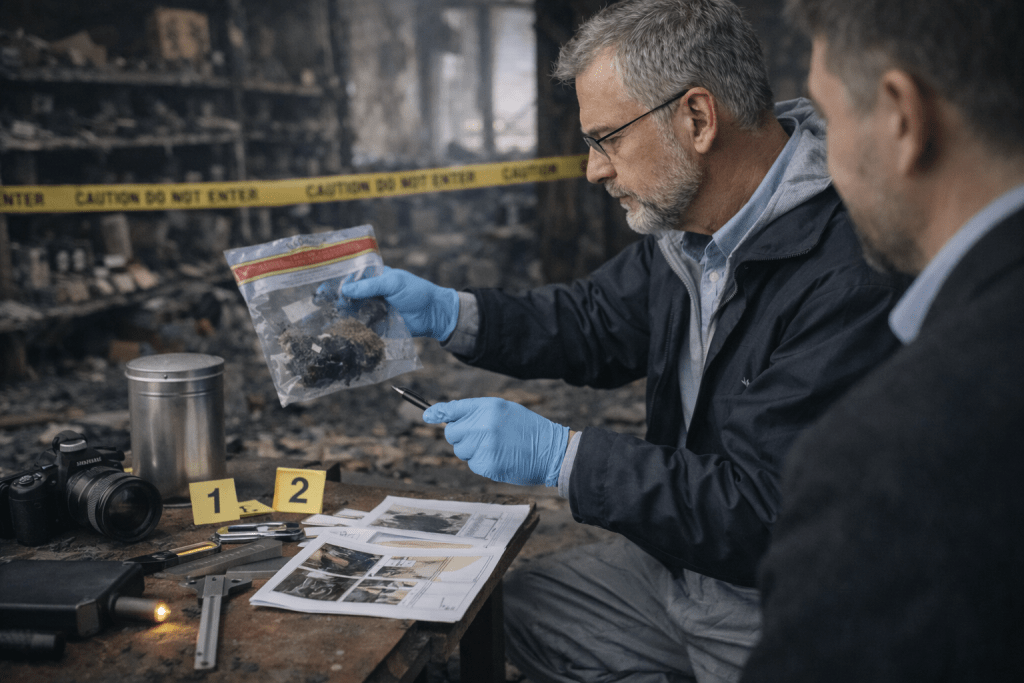

Uncovering the truth in a suspicious claim requires a systematic approach to gathering facts. Experts in this field start by scrutinising the paperwork, which reassures claims managers and legal advisors that investigations are thorough and reliable.

To understand the impact of private investigations, it helps to know what actually counts as insurance fraud. People often ask, “What is considered exaggerating an insurance claim?” or “Why is insurance fraud so hard to prove?” The challenge is that many fraudulent claims are built around partial truths, vague injuries, or carefully timed inconsistencies. Recognising how private investigations uncover hidden truths highlights their importance for claims management and legal review.

Private investigators begin by methodically reviewing the paperwork. Claims forms, medical reports, timelines, and incident descriptions are examined for red flags such as conflicting dates, repeated medical providers, or explanations that don’t align with the physical evidence. This thorough approach reassures claims managers and legal advisors that the investigation is structured and evidence-based, fostering trust in the process.

The goal is always to provide evidence that holds up in a settlement meeting or in court. To do this, investigators interview witnesses to see if their stories match the official report. They often find that minor details provided by a bystander can contradict the entire narrative of a fraudulent claim. Inconsistencies that seem small on paper can become the primary reason a false claim is denied. By focusing on verifiable data rather than hearsay, these professionals ensure that every conclusion is backed by hard proof. For those looking to understand the depth of these processes, professional insurance investigation in Australia provides a clear framework for how these cases are managed from start to finish.

Surveillance Techniques and Digital Evidence

Modern investigations rely heavily on a mix of physical presence and digital footprints. If a person claims they can no longer walk without assistance due to a workplace injury, physical surveillance might tell a different story. When people ask, “Can private investigators legally conduct surveillance?” the answer is yes, when it’s done within the law. Surveillance is one of the most effective tools in insurance fraud investigations, especially in cases involving exaggerated or fabricated injuries.

For example, if a claimant insists they can’t walk or lift objects due to a workplace injury, physical surveillance may reveal them jogging, carrying heavy items, or performing manual labour at home. When surveillance contradicts a claim, it often becomes the deciding factor in denying fraudulent payouts.

Digital evidence has become just as essential as physical monitoring, providing claims managers and legal advisors with confidence in the investigation’s findings. Social media platforms are often the undoing of a fraudster. People frequently post photos of their vacations or physical activities, forgetting that their public profiles are valuable resources for investigators.

Beyond social media, expert computer and digital forensics allow investigators to recover deleted messages or track location data that proves a person wasn’t where they claimed to be during an incident. This combination of “boots on the ground” and “eyes on the screen” makes it clear that the evidence is robust, reassuring stakeholders of its credibility.

The Financial Benefits of Professional Investigation Services

Professional Insurance Fraud Investigations do much more than just catch people in a lie; they save the industry and the public millions of dollars every year. When a fake claim is paid out, that money has to come from somewhere, and it usually results in everyone else’s monthly premiums going up. By stopping fraud before the check is mailed, investigators help keep insurance costs stable for you and your family. Catching even a single high-value fraudulent claim can offset the investigative costs of dozens of other cases, making it a highly efficient way to manage risk.

Beyond the immediate savings, professional investigations act as a powerful deterrent. When word gets out that a company uses specialised insurance investigation services to verify every suspicious detail, scammers are less likely to target them. This creates a safer environment for genuine claimants, as a constant influx of junk claims doesn’t bog down the system. You benefit from a faster, more reliable claims process because the resources are being used exactly where they are supposed to be. It’s about maintaining the integrity of the safety net that we all rely on during difficult times.

Legal Compliance and Verifiable Reporting

The difference between a DIY project and a professional investigation lies in legal compliance, which is crucial for claims managers and legal advisors. Professional investigators understand the strict privacy laws and ethical boundaries that govern their work. Another concern often raised is, “Is insurance fraud investigation legal in Australia?” The distinction between professional investigations and DIY evidence gathering is legal compliance. Privacy laws and ethical boundaries are strict, and evidence obtained illegally can void an entire case.

Professional investigators understand exactly where the legal lines are drawn. They gather evidence in public spaces, rely on lawful databases, and avoid methods that could compromise admissibility. This ensures that evidence can be used confidently in disputes, settlements, or court proceedings.

They also provide structured, professional reports that summarise their findings without all the confusing fluff. A good report is easy to read and gets straight to the point, highlighting the facts that matter most to a claims manager or a lawyer. This clarity is essential when a case moves toward a legal resolution. Having a clear, unbiased account of the facts ensures that the truth is the only thing that matters in the final decision.

Accountability in Action

Private investigations are your best defence against the dishonesty that drives up costs for everyone. By valuing professional work and the pursuit of facts, we can protect the funds meant for people who genuinely need them. The impact of these investigations goes far beyond a single case; it reinforces the importance of truth across the entire insurance industry. When you choose to rely on experts, you support a system built on integrity and accountability.

FAQ: Insurance Fraud Investigations

What is the most common type of insurance fraud?

The most frequent cases involve false or exaggerated injury claims. This includes people pretending to have back pain or “whiplash” that cannot be easily disproven by a standard X-ray, or claiming a workplace injury that actually happened while they were at home.

How long does a typical investigation take?

Most investigations take a few weeks to complete. The timeline depends heavily on how many leads need to be followed, whether surveillance is required, and how quickly digital evidence can be retrieved and analysed.

Is the evidence gathered by private investigators legal?

Yes, as long as the investigator follows local and federal privacy laws. Professional investigators are trained to gather evidence in public spaces and through legal databases, ensuring the evidence is admissible in court or in insurance disputes.